Photo by Dylan Calluy on Unsplash

How to Master Ichimoku Cloud in Forex Trading

What if a single tool could simplify trading and give you a clear view of trends, support, and resistance as well as market momentum? That’s the Ichimoku Cloud in Forex. By understanding and leveraging its unique components, you can transform your trading approach.

Let’s delve deeper into how you can maximize your success in trading Forex with the Ichimoku Cloud.

What Is Ichimoku Cloud in Forex Trading?

The Ichimoku Cloud, or Ichimoku Kinko Hyo, was developed by Japanese journalist Goichi Hosoda in the late 1960s.

Thanks to its intricate Ichimoku Cloud calculation process, it is often considered one of the most comprehensive tools for Forex trading.

It’s renowned as a versatile Ichimoku Cloud indicator that integrates multiple components into a single, intuitive display.

This powerful tool combines multiple data points into a single, intuitive display.

At its core, the Ichimoku Cloud provides:

- Trend direction

- Support and resistance levels

- Momentum strength

- Future market projections

By integrating these insights, traders can make better decisions without cluttering their charts with numerous indicators.

Breaking Down the Ichimoku Cloud

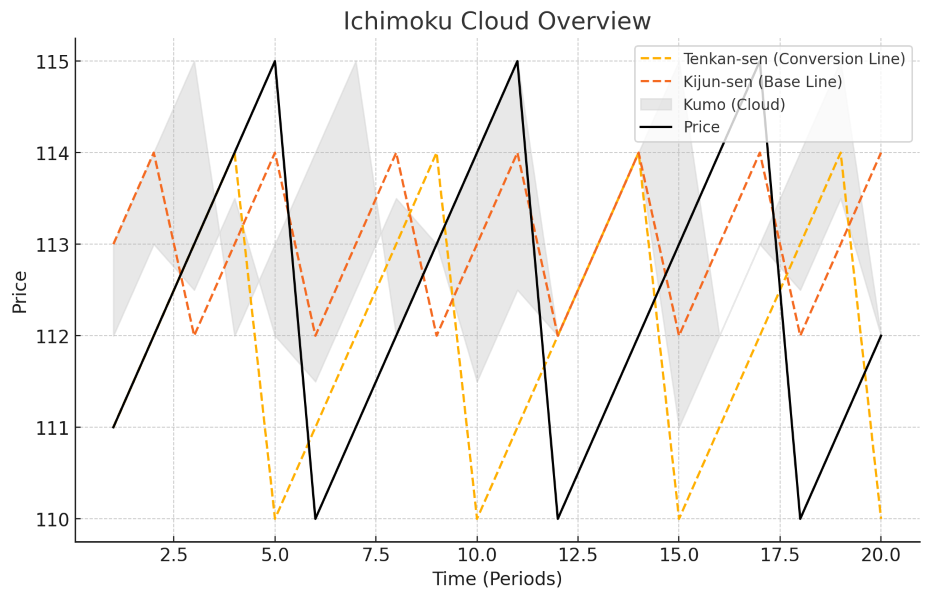

To trade Forex effectively with the Ichimoku Cloud, you need to understand its parameters and key components, as these are crucial to determining the Ichimoku Cloud best settings for your strategy:

- Tenkan-sen (Conversion Line): Represents short-term trends by averaging the 9-period high and low. This component forms part of the Ichimoku Cloud formula, making it essential for accurate analysis. It’s a dynamic indicator of price momentum, calculated using a simple Ichimoku Cloud formula.

- Kijun-sen (Base Line): Reflects medium-term trends, calculated as the average of the 26-period high and low. It’s integral to Ichimoku Cloud calculations.

- Senkou Span A (Leading Span A): An average of the Tenkan-sen and Kijun-sen, plotted 26 periods ahead to form the upper boundary of the cloud. Many traders refine these settings for optimal results.

- Senkou Span B (Leading Span B): An average of the 52-period high and low, also plotted 26 periods ahead to create the lower boundary of the cloud.

- Chikou Span (Lagging Span): The current closing price plotted 26 periods behind, helping to confirm trends.

The “Kumo” or cloud, formed between Senkou Span A and Senkou Span B, is key for identifying trends and can be easily customized on platforms like Ichimoku Cloud MT4 indicator.

It acts as a visual representation of support and resistance and a gauge of market sentiment. For those using the Ichimoku Cloud MT4 indicator, these parameters can be customized for clarity.

Five Key Components of Ichimoku Cloud in Forex

To trade Forex effectively with the Ichimoku Cloud, you need to understand its five key components:

- Tenkan-sen (Conversion Line): Represents short-term trends by averaging the 9-period high and low. It’s a dynamic indicator of price momentum.

- Kijun-sen (Base Line): Reflects medium-term trends, calculated as the average of the 26-period high and low.

- Senkou Span A (Leading Span A): An average of the Tenkan-sen and Kijun-sen, plotted 26 periods ahead to form the upper boundary of the cloud.

- Senkou Span B (Leading Span B): An average of the 52-period high and low, also plotted 26 periods ahead to create the lower boundary of the cloud.

- Chikou Span (Lagging Span): The current closing price plotted 26 periods behind, helping to confirm trends.

The area between Senkou Span A and Senkou Span B is the “Kumo” or cloud. It acts as a visual representation of support and resistance and a gauge of market sentiment.

How to Use the Ichimoku Cloud in Forex Trading

Understanding the Ichimoku Cloud’s best settings and adapting its parameters to your trading style is critical for applying it effectively. Here’s how you can utilize its insights to improve your strategy:

1. Identifying Trends

The Ichimoku Cloud excels at trend identification:

- Price Above the Cloud: Signals an uptrend.

- Price Below the Cloud: Indicates a downtrend.

- Price Inside the Cloud: Suggests consolidation or uncertainty.

For example, consider the EUR/USD pair. If the price breaks above the cloud with increasing momentum, it’s a sign of a potential bullish trend.

2. Generating Buy and Sell Signals

The crossing of the Tenkan-sen and Kijun-sen lines is a critical signal:

- Bullish Signal: When the Tenkan-sen crosses above the Kijun-sen.

- Bearish Signal: When the Tenkan-sen crosses below the Kijun-sen.

Real-Life Example:

A trader observing GBP/USD sees the Tenkan-sen crossing above the Kijun-sen while the price remains above the cloud. This alignment confirms a strong buy signal.

3. Projecting Support and Resistance

The cloud extends 26 periods into the future, offering a predictive view of support and resistance levels. This feature helps traders set stop-loss and take-profit levels.

For instance, when trading USD/JPY, a thick cloud ahead may suggest robust resistance, prompting traders to reconsider entering a long position.

4. Gauging Momentum

The cloud’s shape and size reveal trend strength:

- Wide Cloud: Indicates strong momentum.

- Narrow Cloud: Signals potential reversals or weakening trends.

By observing a widening cloud on AUD/USD, a trader might decide to hold their position, anticipating continued momentum.

Advantages of Using the Ichimoku Cloud in Forex

1. Comprehensive Market View

The Ichimoku Cloud consolidates multiple indicators into a single system, reducing chart clutter and enabling traders to quickly assess market conditions.

2. Forward-Looking Analysis

Unlike lagging indicators, the Ichimoku Cloud provides a projection of future support and resistance, enhancing decision-making.

3. Versatility Across Timeframes

From day traders analyzing 15-minute charts to long-term investors using weekly charts, the Ichimoku Cloud adapts to various trading styles and currency pairs.

4. Noise Reduction with Ichimoku Cloud in Forex

The cloud filters out insignificant price fluctuations, allowing traders to focus on meaningful movements.

Common Pitfalls and How to Avoid Them

1. Overreliance on Ichimoku Cloud in Forex

While the Ichimoku Cloud is a robust tool, relying on it exclusively can lead to misjudgments.

Combine it with other indicators like RSI or Fibonacci retracements for a well-rounded strategy.

2. Ignoring Multiple Timeframes

Signals can vary across timeframes. Always analyze multiple timeframes to confirm trends.

Example:

A bullish signal on a 1-hour chart may conflict with a bearish trend on the daily chart. Aligning these perspectives ensures better accuracy.

3. Neglecting Market Context

No indicator is immune to false signals. Keep an eye on fundamental factors like interest rate decisions or geopolitical events.

4. Acting on Impulse

The Ichimoku Cloud is best suited for medium to long-term trading. Avoid reacting to short-term price spikes without proper confirmation.

Real-Life Application

Scenario: Trading EUR/USD with Ichimoku Cloud in Forex

- Market Analysis: The EUR/USD price is trending above the cloud on the 4-hour chart, indicating an uptrend.

- Signal Confirmation: The Tenkan-sen crosses above the Kijun-sen, strengthening the bullish signal.

- Momentum Check: The cloud is widening, confirming strong upward momentum.

- Trade Execution: A trader enters a long position with a stop-loss set below the cloud and a take-profit target near the next resistance level projected by the cloud.

By following this systematic approach, the trader capitalizes on the trend while managing risk effectively.

Tips for Successful Trading with Ichimoku Cloud in Forex

- Combine with Fundamental Analysis: Use economic data and news events to validate technical signals.

- Practice on a Demo Account: Familiarize yourself with Ichimoku Cloud dynamics before trading live.

- Focus on Major Pairs: Pairs like EUR/USD and USD/JPY tend to exhibit clearer trends, making them ideal for Ichimoku analysis.

- Stay Patient: The Ichimoku Cloud is designed for medium to long-term trading. Allow time for signals to develop.

Conclusion

The Ichimoku Cloud offers a unique, holistic view of the Forex market. It combines trend identification, momentum analysis, and future projections in one powerful tool.

But remember, no tool guarantees success. The key lies in combining Ichimoku Cloud insights with a disciplined approach, sound risk management, and continuous learning.

Start your journey today with StyleForex.com—your partner in the exciting world of Forex trading. Unlock expert insights, practical tips, and a suite of resources designed for traders at every level