Photo by Choong Deng Xiang on Unsplash

Forex Moving Average Crossovers: How to Master Trend Signals

Are you trying to improve your Forex trading skills? Forex Moving Average Crossovers can help you spot changes in trends and find the best times to enter or exit trades.

But does moving average crossover work consistently in all market conditions? This is a question many traders explore while refining their strategies.

This strategy is easy to understand and can make your trading decisions more confident.

In this guide, we’ll explain what moving average crossovers are, how they work, and how you can use them in your trading. We’ll also include examples to make everything clear and easy to follow.

What Are Forex Moving Averages?

To understand crossovers, you first need to know about moving averages. A moving average is a tool traders use to see the overall direction of the market.

It calculates the average price of a currency pair over a certain number of days and updates as new prices come in.

Types of Moving Averages

- Simple Moving Average (SMA):

- This type averages the prices over a specific period.

- For example, to find a 10-day SMA, add up the closing prices from the last 10 days and divide by 10. Many traders also experiment with settings like the 20, 50, and 200 day moving average crossover to identify long-term trends.

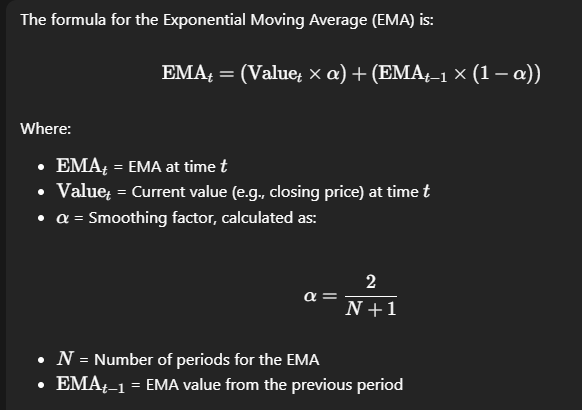

2. Exponential Moving Average (EMA):

- This gives more importance to recent prices, making it react faster to changes.

- For example, to calculate a 10-day EMA, use the formula:

Other types of moving averages include: Weighted Moving Average (WMA) and Smoothed Moving Average (SMMA)

Most traders use SMA or EMA because they are straightforward and effective. Long-term traders often prefer SMA because it’s steady, while short-term traders like EMA for its quick reactions.

What Are Forex Moving Average Crossovers?

A crossover happens when two moving averages, like an SMA and EMA, intersect. This concept is often central to a 3 moving average crossover strategy.

It uses multiple averages for added confirmation of trend strength. This crossing signals a possible change in the market trend.

Types of Crossovers

- Golden Cross:

- A bullish signal where a short-term moving average crosses above a long-term moving average.

2. Death Cross:

- A bearish signal where a short-term moving average crosses below a long-term moving average.

3. Multiple Crossovers:

- Uses three or more moving averages for stronger confirmation of trends.

How to Use Crossovers in Trading

Crossovers can help you decide when to start or stop a trade.

Entry Points

- Buy Signal: When a short-term moving average crosses above a long-term moving average.

- Sell Signal: When a short-term moving average crosses below a long-term moving average.

Exit Points

- Exit Long Position: When the short-term moving average crosses below the long-term moving average.

- Exit Short Position: When the short-term moving average crosses above the long-term moving average.

Example:

Let’s say you’re using a 10-day EMA and a 50-day EMA. If the 10-day EMA crosses above the 50-day EMA, that’s a buy signal. If it crosses below, that’s a sell signal.

This system makes decisions easier and reduces emotional trading.

Advantages of Forex Moving Average Crossovers

Moving Average Crossovers are popular because they:

- Simplify Decisions:

- They give clear points for entering and exiting trades.

2. Identify Trends:

- They help you figure out whether the market is going up or down.

3. Work on Any Timeframe:

- You can use them for both short-term and long-term trading.

4. Automate Easily:

- They are easy to include in automated trading systems.

Real-Life Example

A trader watching the EUR/USD pair sees the 20-period EMA cross above the 50-period EMA on a 1-hour chart.

This Golden Cross suggests the price might go up. The trader enters a buy trade and profits as the trend continues upward.

Limitations and Risks

Crossovers aren’t perfect, and traders should be aware of their weaknesses:

- Lagging Signals:

- Moving averages show trends based on past prices, so they may react late to sudden changes.

2. False Signals:

- In sideways or choppy markets, crossovers can give wrong signals, causing unnecessary trades.

3. Whipsaws:

- Quick market reversals can lead to frequent signals that result in small losses.

Example of a Risk

A trader spots a Death Cross on GBP/USD and decides to sell. However, unexpected news causes the price to rise, turning the trade into a loss.

This shows why crossovers should be used alongside other tools.

Tips for Success

Here are some tips to get the most out of moving average crossovers:

- Use Additional Tools:

- Combine crossovers with indicators like RSI or MACD for stronger signals.

2. Experiment with Timeframes:

- Test different moving average lengths to find what works best for you. For instance, exploring moving average crossover settings tailored to your trading style can significantly improve results.

3. Check Multiple Charts:

- Look at larger timeframes for the overall trend and smaller timeframes for precise entries.

4. Manage Risks:

- Always set stop-loss orders and choose trade sizes carefully.

5. Backtest Your Strategy:

- Try your crossover system on historical data to see how well it works.

Real-Life Application

A trader using USD/JPY combines moving average crossovers with MACD. By checking multiple timeframes, they avoid false signals and make steady profits over several months.

Conclusion

Moving Average Crossovers are useful tools that make trading simpler by providing clear signals for entering and exiting trades.

They also play a critical role in strategies like the moving average crossover in Forex trading, especially for identifying trend reversals.

They are great for spotting trends but should be used with other tools to avoid false signals.

To succeed in trading, you need more than just indicators. You also need a strategy that matches your goals and risk tolerance.

Ready to enhance your trading? Start exploring Forex Moving Average Crossovers today and see the difference they can make!

Learn more about Forex strategies at StyleForex.com and take your skills to the next level.