How to Use a Forex Trading Journal to Boost Your Trading

If you’re new to Forex trading, it’s tempting to trade without a plan. But what if there was a way? A way to uncover hidden patterns and transform your trading results? There’s an indispensable tool can make this possible: a Forex trading journal.

More than just a log of your activities, this journal serves as a comprehensive forex trading journal template to guide you toward trading success.

So, let’s find out why a Forex trading journal is so crucial and how to craft one that drives consistent improvement.

What is a Forex Trading Journal?

A Forex trading journal acts like a personal diary, recording each step of your trading journey.

From strategies to emotional responses, it captures detailed insights about your trades and market observations.

More than a simple log, it’s a tool to identify patterns, refine strategies, and foster growth.

Note: Professional traders in institutions often rely on detailed logs to backtest strategies and refine their decision-making process.

Adopting this habit puts you on the same trajectory as seasoned market experts.

Why Should You Keep a Forex Trading Journal?

Here’s the critical part. By keeping a trading journal, you can transform your trading habits and decision-making process.

Here are five compelling reasons to start journaling your trades:

- Track Your Progress: Regular entries enable you to measure your performance over time. This makes it easier to see improvements.

- Identify Strengths and Weaknesses: Pinpoint which strategies yield success and which ones need adjustment.

- Learn from Mistakes: Analyze losing trades to avoid repeating errors.

- Cultivate Discipline: A consistent journaling routine reinforces good trading habits and adherence to your plan.

- Manage Emotional Biases: Documenting emotions can help you recognize and control feelings like fear or greed.

Real-life Scenario: A trader records all instances where impulsive decisions led to losses. Reviewing these entries reveals a pattern of overtrading during high volatility.

As such, this proactive way encourages the trader to adopt a rule-based approach.

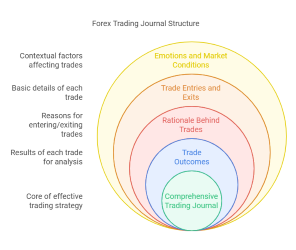

Key Components of a Forex Trading Journal

To maximize the benefits of your journal, include the following elements:

- Date and Time: When the trade occurred.

- Currency Pair: The market you traded (e.g., EUR/USD).

- Position Size: Lot size and whether it was a buy or sell order.

- Entry and Exit Prices: The exact points where you entered and exited the trade.

- Stop Loss and Take Profit Levels: Risk management parameters.

- Reason for Entering the Trade: Your analysis and strategy.

- Market Conditions: Context, such as trends or key news events.

- Outcome: Profit or loss, measured in pips or dollars.

- Emotional State: Your mindset during the trade.

- Lessons Learned: Insights for future trades.

How to Create a Forex Trading Journal

Follow these steps to set up and maintain your journal effectively using a forex trading journal template, keeping in mind that it is an ongoing process requiring consistent effort:

- Choose a Format: Use a notebook, spreadsheet, or a dedicated trading journal app. Popular tools like Excel are great for creating a forex trading journal excel, while online apps like Edgewonk offer flexibility and advanced features.

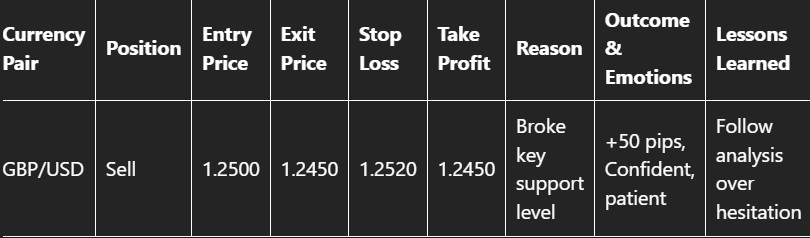

2. Design a Template: Include columns for the key components listed above.

Example template:

- Update Regularly: Record each trade immediately or at the end of the day using your chosen forex trading journal online or offline format to ensure accuracy.

4. Add Visuals: Incorporate screenshots of charts to enhance your entries.

5. Be Honest: Document both wins and losses with transparency.

Tips for Maintaining Your Journal

- Be Detailed: Include as much information as possible.

- Stick to a Routine: Make journaling a part of your trading day.

- Review Entries: Weekly or monthly reviews help uncover trends.

- Analyze Honestly: Record your emotional responses candidly.

- Use Insights to Improve: Adjust strategies based on your findings.

Pro-Tip: A trader notices consistent losses during news releases. By reviewing the journal, they realize they lack a clear news trading strategy.

Hence, thay decide to avoid trading during high-impact events.

As a result, their overall win rate improves significantly. Thus, they feel more confident sticking to their defined trading plan, and this leads to steadier profits over time.

Analyzing Your Forex Trading Journal

Your journal’s real power lies in the insights it offers. Here’s how to analyze it:

- Identify Patterns: Which currency pairs or timeframes work best?

- Calculate Metrics: Measure your win rate, average profit/loss, and risk-reward ratio. For example, if you have 50 trades with 30 wins and 20 losses, your win rate is (30/50) x 100 = 60%. To calculate average profit/loss, sum up all your profits and losses and divide by the total number of trades. Finally, your risk-reward ratio can be calculated by dividing your average profit by your average loss.

- Review Risk Management: Check adherence to stop-loss and take-profit rules.

- Evaluate Emotional Impact: Determine how emotions influence decisions.

- Set Goals: Use data to establish actionable targets.

By analyzing your journal regularly, you can turn data into actionable changes, improving your strategy and results.

Example Metric:

If you record 100 trades with 65 wins and 35 losses, your win rate is 65%. This indicates a profitable edge if your average win exceeds your average loss.

Conclusion

A Forex trading journal is your secret weapon for mastering the markets. By diligently documenting and analyzing your trades, you’ll build discipline, uncover valuable insights, and improve over time.

Remember, consistency is key—both in updating your journal and in applying its lessons.

The journey to trading success starts with understanding yourself, and a forex trading journal free or personalized can be the perfect bridge to that understanding.

Start your journey today with StyleForex.com—your partner in the exciting world of Forex trading. Unlock expert insights, practical tips, and a suite of resources designed for traders at every level.

Take the first step today and watch your trading skills flourish!